Do Husband and Wife LLCs Have to File Form 1065? Tax Filing Rules Explained

Do husband and wife LLCs need to file Form 1065? Learn the federal tax classification rules, including differences between community property and separate property states and when partnership filing is required.

How to Reimburse Business Expenses Without Triggering Payroll Tax or Guaranteed Payments

Business owners often reimburse expenses incorrectly. Learn how S corporations and partnerships can reimburse expenses without triggering payroll tax, guaranteed payments, or audit risk.

Proposed Student Loan Rules Could Limit Graduate Borrowing and Redefine Which Degrees Qualify as Professional

Proposed Department of Education rules could cap graduate student loans and redefine which degrees qualify as professional. Learn how the changes may affect education financing and tax planning.

When Government Related Bonds Are Truly Tax Exempt and When They Are Not

Revenue Ruling 2026-4 explains when government related bonds qualify as tax exempt and why many do not. Learn how IRS rules affect bond interest.

Why Most Homeowners Associations Cannot Qualify as Tax Exempt Social Clubs

The IRS explains why most homeowners associations do not qualify as tax exempt social clubs. Learn what activities disqualify HOAs and how tax exposure arises.

Why the IRS Shut Down a Mental Health Charity: A Warning for Nonprofits and Donors

The IRS denied 501(c)(3) status to a mental health charity after finding improper private benefit to for profit providers. Learn what triggered the ruling and how nonprofits and donors can avoid costly mistakes.

Your Tax Preparer Lied on Your Return and the IRS Can Still Come After You

A federal appeals court ruled that the IRS can assess tax decades later if a tax preparer committed fraud, even when the taxpayer acted in good faith. Learn what this means for you.

How W2 Wages Can Increase or Reduce Your Section 199A Deduction

Learn how W2 wages interact with the Section 199A Qualified Business Income deduction. Understand income thresholds, wage limitations, and planning considerations for S corporations, partnerships, and other business owners.

Who Qualifies for the Qualified Overtime Compensation Deduction and What the IRS Rules Say

Understand who qualifies for the qualified overtime compensation deduction, including federal employees, income limits, and IRS eligibility rules.

New Rural Opportunity Zone Tax Break: 50% Improvement Rule Explained for Business Owners

IRS Notice 2025-50 reduces the Opportunity Zone improvement requirement to 50% for rural projects. Learn how business owners and real estate investors can qualify with less capital.

Why Most IRS Issues Never Become Audits and How a Strained IRS Resolves Them

Most IRS notices and delays are resolved without audits. Learn why enforcement is rare and how proactive tax planning keeps taxpayers out of enforcement and speeds resolution.

100% Bonus Depreciation Is Back Permanently: What IRS Notice 2026-11 Means for Businesses

IRS Notice 2026-11 confirms that 100% bonus depreciation is permanently restored under OBBBA. Learn which property qualifies, acquisition date rules, elections, and planning impacts for businesses.

California Proposition 19 and Inherited Homes: How Property Taxes Are Reassessed

California Proposition 19 changed how inherited homes are taxed. Learn when property taxes are reassessed, how the $1,000,000 adjusted exclusion works, and common planning mistakes.

Limited Partners and Self Employment Tax After the Fifth Circuit Ruling

A Fifth Circuit decision rejected the IRS functional test and restored the statutory self employment tax exclusion for limited partners. Learn who qualifies, what income is excluded, and why geography now matters.

New Tax Benefits Are Now Unavailable to ITIN Filers Without a Social Security Number

Several new federal tax benefits now require a Social Security number and are no longer available to ITIN filers. Learn which credits and exclusions are affected and how this impacts tax planning.

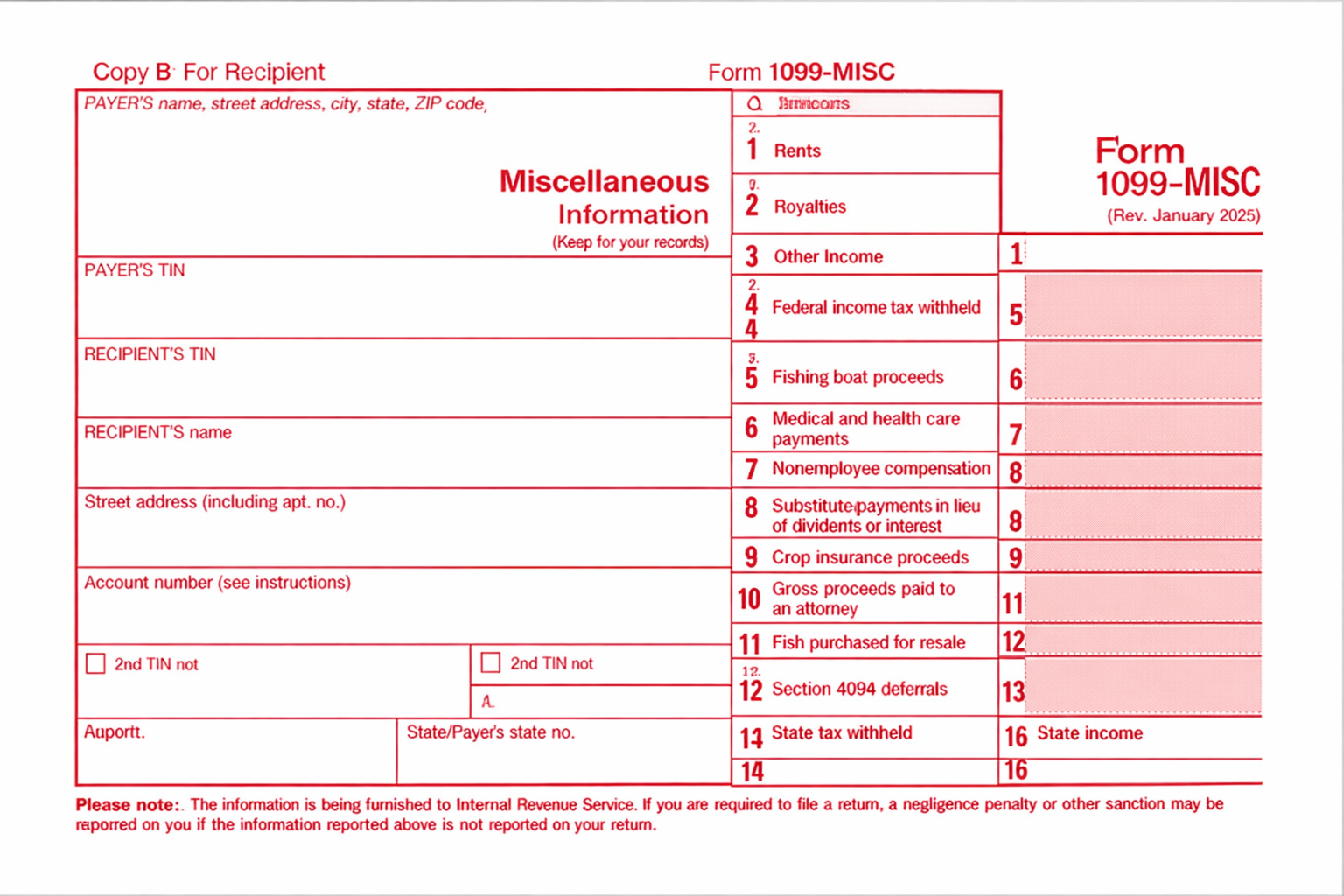

1099 Reporting Changes for 2026: New Thresholds and California Conformity

Starting in 2026, federal law raises the 1099-NEC and 1099-MISC threshold to $2,000 and restores the 1099-K $20,000 and 200 transaction rule. Learn how the new rules apply and how California conforms.

Bonus Depreciation vs Section 179: Which Is Better for Business Owners After OBBBA

Bonus depreciation and Section 179 both allow immediate write offs, but the tax results are very different. Learn which works better after OBBBA and how California taxes change the answer.

Form 1099-DA Does Not Replace Your Crypto Records. What Taxpayers Must Still Report

Form 1099-DA reports crypto proceeds only. Taxpayers must still provide cost basis, dates, and wallet activity to report gains correctly. Learn what is required and why.

Qualified Production Property Under OBBBA Turns Production Buildings Into Immediate Tax Deductions

Qualified Production Property under the One Big Beautiful Bill Act allows manufacturers to deduct production building costs immediately. Learn how businesses can benefit from 2025 through 2030.

Which Vehicles Qualify for the Auto Loan Interest Deduction Under OBBBA

Which vehicles qualify for the new auto loan interest deduction under OBBBA? Learn the required vehicle type, weight limits, new vehicle rules, and United States manufacturing requirement.