2025 State-by-State Total Income Taxes at $100k and $200k

The tax code contains many preferences that depend on each taxpayer’s facts. A common policy example is a family of four, so I use that profile here. I compare $100,000 and $200,000 of wage income, which bracket the median income range for four-person households in recent Census data.

The recently enacted One Big Beautiful Bill Act (OBBBA) reduces the burden on many wage earners by making current individual tax rates permanent and providing targeted relief for tips, overtime, and certain passenger-vehicle loan interest. The higher standard deduction also narrows the gap for taxpayers who do not itemize, such as non-homeowners or those without large charitable contributions.

Calculating tax is not simple at the federal level or in the 41 states and D.C. that levy an income tax. Because each state conforms to federal law differently and applies its own deductions and credits, two families with similar wages can face very different liabilities.

This analysis compares the resulting tax burden across states using these basic assumptions:

$100,000 and $200,000 in wage income, with no other income

Married filing jointly, both spouses under age 65, with two children under age 6

Standard deduction (no itemizing)

No other deductions

State-by-state combined effective tax rate at $100,000 wages, MFJ with two children under six, 2025

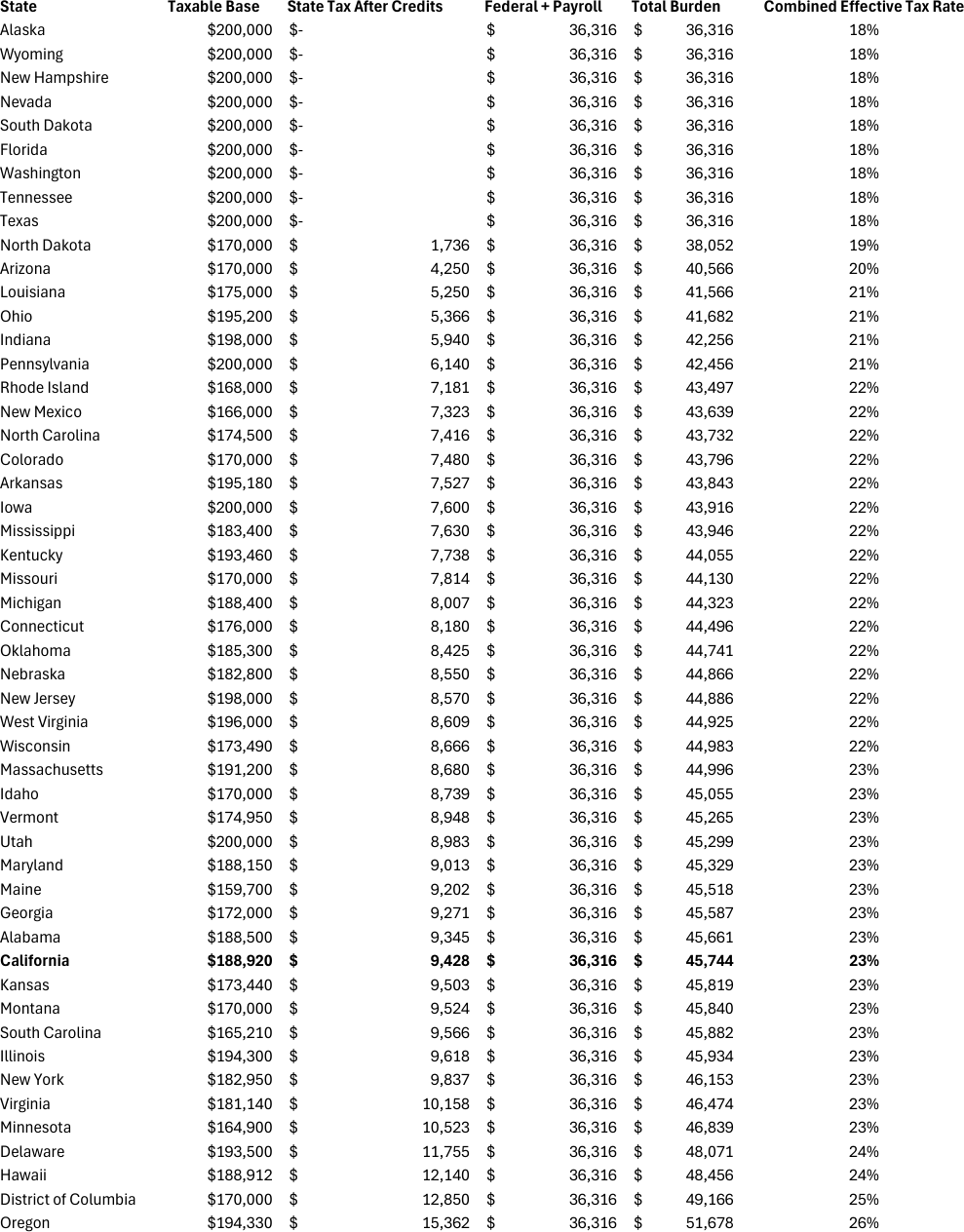

State-by-state combined effective tax rate at $200,000 wages, MFJ with two children under six, 2025

The states with an 11% effective rate at $100K and 18% at $200K are states with no state income tax on its residents. Of income-tax states, the state with the lowest combined effective tax rate is California at 12.3% at the $100K wage level. Surprising given its higher marginal tax rates, California’s system continues to prove remarkably progressive compared to other states with a state level income tax. However, this changes at the $200K wage level with California ranked 30th of income-tax states in overall wage tax burden at 22.87%.

Oregon ranks highest at both income levels at 17.6% and 25.84%, respectively. That burden should be considered alongside Oregon’s 0% sales tax, which this analysis does not factor in.

North Dakota has no state income tax at $100,000 under these assumptions. At $200,000, state income tax is about $1,736, producing a 19.03% combined effective rate. The state is the lowest among income-tax states at that income level.

State-by-state combined effective tax rate at $100,000 wages, MFJ with two children under six, 2025

State-by-state combined effective tax rate at $200,000 wages, MFJ with two children under six, 2025

Federal + Payroll (for all states)

Employee FICA included 6.2% Social Security on wages up to $176,100 for 2025 and 1.45% Medicare on all wages. The 0.9% Additional Medicare surtax threshold for MFJ is $250,000, so it did not apply at $100,000 and $200,000 of wages. Sources: SSA wage base 2025, IRS Topic 751: Social Security and Medicare Withholding Rates, and IRS Topic 560: Additional Medicare Tax.

Family utilizes Child Tax Credit (CTC) = $2,200 per child under OBBBA.

Employee payroll taxes at $100,000 are $7,650 (6.2% Social Security up to the wage base + 1.45% Medicare). This yields Federal + Payroll = $10,993 for the federal plus payroll tax burden identical across states.

Employee payroll taxes at $200,000 are $13,818.20 (6.2% Social Security up to the $176,100 wage base + 1.45% Medicare on all wages; no 0.9% Additional Medicare Tax at $200,000 MFJ). This yields Federal + Payroll = $36,316, identical across states.

Used the $31,500 married filing joint standard deduction for 2025 enacted by OBBBA. See PwC: U.S. Individual Deductions (OBBBA update)

Taxable Base = state-taxable income before any state credits, computed as

Wages ($100,000 or $200,000) minus the state’s standard deduction (if any) minus any personal exemption deductions or universally available subtractions that apply to a married filing jointly couple with two dependents under age 6.It does not include or net out credits of any kind. Credits are applied later and shown in State Tax After Credits.

It does not use itemized deductions. Per your assumption I used the standard deduction only.

It does not reflect federal items, payroll taxes, or federal credits.

No-income-tax states (AK, FL, NV, NH, SD, TN, TX, WA, WY): The base is shown as AGI with $0 state tax.

State-by-State notes

Alabama – No broad child credit at this income; used 2025 rates/deductions. Tax Foundation 2025 State Rates

Alaska – No state individual income tax. Tax Foundation 2025 State Rates

Arizona – Flat tax system; no child/dependent credit affecting $100k. Tax Foundation 2025 State Rates

Arkansas – Used published 2025 brackets/SD; no family credit at $100k. Tax Foundation 2025 State Rates

California – Used 2025 Form 540-ES SD figures (MFJ $11,080); no CTC at this income. FTB 2025 540-ES Instructions

Colorado – Flat rate; no state CTC at $100k. Tax Foundation 2025 State Rates

Connecticut – Applied Personal Tax Credit factor; at $99,500–$100,000 MFJ = .02 of tentative tax. CT-1040 Instructions — Table E CT.gov

Delaware – Brackets per 2025 tables; no child credit at $100k. Tax Foundation 2025 State Rates

District of Columbia – Claimed Young Child Tax Credit $420/child under 6 (refundable) subject to AGI thresholds; at $100k MFJ, credit allowed. DC OTR — Child Tax Credit Urban Institute

Florida – No state individual income tax. Tax Foundation 2025 State Rates

Georgia – Used 2025 rates/SD; no qualifying state CTC at $100k. Tax Foundation 2025 State Rates

Hawaii – Considered Refundable Food/Excise Credit; at $100k MFJ, not eligible under current AGI thresholds. Hawaii DOTAX — Food/Excise Credit Flyer

Idaho – Applied $205 nonrefundable Child Tax Credit per child (Idaho Code §63-3029L). Idaho State Tax Commission — §63-3029L

Illinois – Flat tax; no state CTC at $100k. Tax Foundation 2025 State Rates

Indiana – Flat tax; no state CTC at $100k. Tax Foundation 2025 State Rates

Iowa – Used 2025 rates; no child/dependent credit at $100k. Tax Foundation 2025 State Rates

Kansas – Used 2025 brackets; no state CTC at $100k. Tax Foundation 2025 State Rates

Kentucky – Flat tax; no state CTC at $100k. Tax Foundation 2025 State Rates

Louisiana – Used 2025 brackets/SD; no state CTC at $100k. Tax Foundation 2025 State Rates

Maine – Applied Dependent Exemption Tax Credit = $300 per dependent (refundable from 2024 forward). Maine Revenue — DETC

Maryland – Used 2025 state/local tables; state CTC targeted to very low incomes, so none at $100k. Tax Foundation 2025 State Rates

Massachusetts – Applied Child & Family Tax Credit $440 per dependent (no cap on number). Mass. DOR — CFTC

Michigan – Flat rate; no state CTC at $100k. Tax Foundation 2025 State Rates

Minnesota – New refundable CTC phases out by $100k+ MFJ; none allowed at $100k with two kids under 6 per current thresholds. Tax Foundation 2025 State Rates

Mississippi – No state CTC; used 2025 rates. Tax Foundation 2025 State Rates

Missouri – Used 2025 rates; no state CTC at $100k. Tax Foundation 2025 State Rates

Montana – 2025 rates with SD; CTC phases out well below $100k MFJ. Tax Foundation 2025 State Rates

Nebraska – 2025 rates; no CTC at $100k. Tax Foundation 2025 State Rates

Nevada- No state individual income tax on wages. We treated state income tax as zero. See Nevada DOR: Income Tax in Nevada. State of Nevada

New Hampshire- Wage income not taxed. The Interest and Dividends Tax is fully repealed for tax years beginning on or after Jan 1, 2025. See New Hampshire DRA: Interest & Dividends Tax FAQ.

New Jersey- At $100,000 MFJ there is no NJ child tax credit because NJ’s refundable CTC for children under age 6 phases out above $80,000 taxable income. See NJ Division of Taxation: Child Tax Credit.

New Mexico- Applied the New Mexico Child Income Tax Credit schedule for two young dependents. At $100,000 MFJ the credit is the lower-tier amount set by statute for 2025. See NM Taxation & Revenue: Child Income Tax Credit and the Department’s credit table.

New York- Used the Empire State Child Credit per Form IT-213 Instructions which compute the credit as 33% of the federal child tax credit allowed under 2017 law or $100 per child, whichever is greater. Note that New York authorized additional ESCC payments separately, but the underlying IT-213 formula remains as in the instructions. See NY DTF: IT-213 Instructions and NY DTF: Additional Empire State Child Credit Payments.

North Carolina- Modeled flat 4.25% individual income tax rate for 2025. No separate state CTC at this income; standard NC deductions applied per statute. See NC DOR: Tax Rate Schedules.

North Dakota- Applied 2025 ND brackets which include a 0% bracket followed by positive rates. See ND Tax Commissioner: 2025 Individual Rate Tables (Form ND-1ES).

Ohio- No broad state CTC. The Joint Filing Credit was not included because we modeled a single-earner household; that credit generally requires both spouses to have qualifying income. See Ohio Tax Credits and Their Required Documentation

Oklahoma- Included the greater of 5% of the federal Child Tax Credit or 20% of the federal Child and Dependent Care Credit, subject to the $100,000 MFJ AGI cap. See Oklahoma Admin. Code 710:50-15-71.

Oregon- I compute the base as AGI minus Oregon’s standard deduction. Oregon’s personal exemption is a credit, so it is not part of the base and is applied after. Used 2025 Oregon standard deduction and personal exemption credit amounts in computing state tax. At $100,000 MFJ, the Oregon Kids Credit does not apply because eligibility phases out around $30,750 of modified AGI. Oregon DOR: Oregon Kids Credit.

Pennsylvania- Modeled the flat 3.07% PIT. We did not include the PA Child and Dependent Care Enhancement Credit because it depends on actual care expenses; if a client incurs those, PA’s enhancement mirrors a percentage of the federal CDCTC. See PA DOR: Personal Income Tax and PA announcement on the enhancement credit. IRSPennsylvania.gov

Rhode Island- No ongoing state CTC at this income. The 2022 one-time child tax rebate program was temporary and not modeled. See the state’s fact sheet reference for the 2022 rebate.

South Carolina- No general state CTC. The Two-Wage Earner Credit was not included because we modeled one earner. See SC DOR: Individual Income Tax Credits.

South Dakota- No state individual income tax. We treated state income tax as zero. See South Dakota DOR: Income Tax.

Tennessee- No state individual income tax. The Hall income tax on interest and dividends was fully repealed beginning in 2021, so no state income tax applied. See Tennessee DOR: Hall Income Tax (repealed).

Texas- No state individual income tax. We treated state income tax as zero. (Texas Constitution restricts an income tax and none is currently imposed.)

Utah- Utah calculates tax as 4.5% of Utah AGI minus the Utah Taxpayer Tax Credit, so I show AGI as the Taxable Base and apply the credit after. Applied the Utah Taxpayer Tax Credit per the formula in TC-40 instructions. We also evaluated the Utah nonrefundable Child Tax Credit that applies only for children ages 1 to 3 with phase-outs; it was included only if the dependent ages met that rule. See Utah State Tax Commission: TC-40 Instructions and Utah Individual Income Tax page.

Vermont- Included the Vermont Child Tax Credit of $1,000 per child under age 6 subject to AGI limits; at $100,000 MFJ, the family generally qualifies. See Vermont Department of Taxes: Child Tax Credit.

Virginia- No state CTC. Used Virginia’s current standard deduction amounts and brackets for 2025; Virginia’s standard deduction for MFJ was recently increased by legislation. See Virginia Tax: 2024–2025 Legislative Summary.

Washington- No state individual income tax on wages.

West Virginia- No broad state CTC. Applied regular WV PIT rules and rates; no additional credits at this income assumed. See WV State Tax Department: Personal Income Tax.

Wisconsin- No state CTC. The Married Couple Credit was not included because it requires both spouses to have earned income; we modeled a single-earner household. See Wisconsin Form 1 Instructions 2024, Married Couple Credit guidance.

Wyoming- No state individual income tax. See the Tax Foundation’s Wyoming overview confirming no individual income tax. Tax Foundation

Notes on state credits at $200k

Dropped high-AGI credits (e.g., CT personal tax credit, DC young child credit, OK 5% CTC piggyback, VT CTC, NM child income tax credit) because they phase out well below $200k MFJ.

Kept credits that still apply broadly at this level (e.g., CA exemption credits, ME Dependent Exemption Tax Credit (under-6), MA Child & Family Tax Credit, ID $205 child credit, OR personal exemption credits).

Utah recalculated using the Taxpayer Tax Credit formula at $200k.

As this 50-state comparison shows, a family earning $100,000 or $200,000 can face very different results once state credits, deductions, and payroll taxes are applied and the gap can be thousands of dollars. I help families translate these rules into actionable steps: confirming eligibility for various state and federal credits, optimizing withholding to avoid surprises, and building a year-round plan that uses retirement contributions to lower your overall burden. If you would like a precise, state-tailored projection for your household and a checklist you can execute before year-end, Schedule a Tax Planning Strategy Session

Links

Tax planning for high-income families → https://www.stevenjcpa.com/services

OBBBA effective dates: what starts now, what ends when → https://www.stevenjcpa.com/insights/obbba-effective-dates-what-starts-now-what-ends-when

California after OBBBA: what Sacramento may conform to → https://www.stevenjcpa.com/insights/california-after-obbba-what-sacramento-may-conform-to-what-it-will-likely-leave-behind